As fraud attacks grow more sophisticated, a need for contextual detection strategies increases

Fraudsters are using a complex array of tools to build armies of fake accounts, 74% of all fraudulent accounts are created from desktops, and cloud service provider IP ranges are at a higher risk.

How fraudsters behave

Fraudsters rely heavily on cloud datacenter IP ranges and cloud services are becoming a favorite attack tool; whether to mask the true origin of fraudulent accounts or to easily orchestrate attacks at scale by exploiting virtual servers, according to the DataVisor quarterly fraud index report.

Drawing on proprietary analysis of over 44 billion events across 800 million active user accounts globally, the report highlights the rapidly increasing complexity of emerging attacks and the dire need for contextual detection strategies to proactively defeat fraud before damage occurs.

“This quarter’s report drives home the point that for teams to be able to determine what is fraudulent activity and what is legitimate, the right amount of technology needs to be in place,” said Ting-Fang Yen, Director of Research at DataVisor.

“As it becomes increasingly challenging to block the efforts of fraudsters, learning how they operate will deliver critical insight to any organization, empowering them to make the best choices in determining how to fight back.”

The financial services sector is bearing the brunt of rapidly scaling fraud

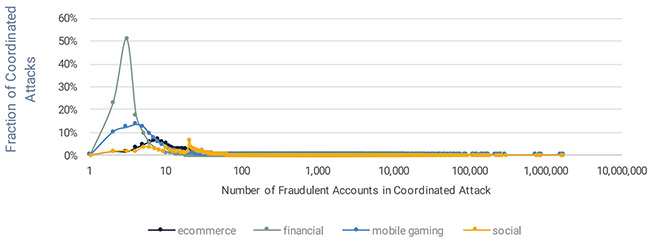

Some 80% of coordinated attacks in financial use cases involve actions such as account takeovers, and such attacks are typically stealthier and conducted using a complex combination of manual and bot-powered methods.

Social platforms, by comparison, continue to endure the most massive onslaughts, with some attacks consisting of hundreds of thousands of fraudulent accounts—90-95% of these use cases involved fake registrations and fake installs.

Fraudsters continue to use multiple tools

Less sophisticated fraud attacks remain easier to detect and block, so increases in complexity, coordination, and sophistication should be of particular concern. As fraudsters continue to use multiple tools to try and obscure their efforts and blend their fraudulent accounts with legitimate ones, their need for comprehensive fraud management at big data scale increases.

Through detailed analysis of specific attack examples, the report delivers concrete guidance on how to extract intelligence from data to improve digital security and thwart even the most sophisticated fraudsters.

What is evident from DataVisor’s comprehensive global research is that proactive fraud prevention requires a nuanced and detailed understanding of user behavior patterns.

This is only possible through the deployment of highly sophisticated models that can surface behavioral anomalies. Organizations simply cannot expect to move faster than the speed of fraud without the ability to accurately analyze and process massive amounts of data.

The costs of failing to do so are both reputational and financial—lost revenue and assets, increased operational costs, and eroded trust.

“It is clear that a 360-degree view of data is key when confronting the online fraud world today,” continued Yen.

“This report draws on our previous research and digs deep to put power back into the hands of organizations. By recognizing that malicious actors are growing more sophisticated–and that the tools they use are likely as technologically advanced as that of the enterprise–the power lies within analyzing every data signal to draw out the necessary intelligence. Powerful machine learning capabilities prove best in this situation to deliver the ultimate customer experience while keeping the organization safe.”