SEON Identity Verification combines KYC checks with real-time fraud intelligence

SEON has unveiled the launch of its AI-powered Identity Verification solution, bringing ID verification, liveness detection and proof of address checks into its unified risk platform.

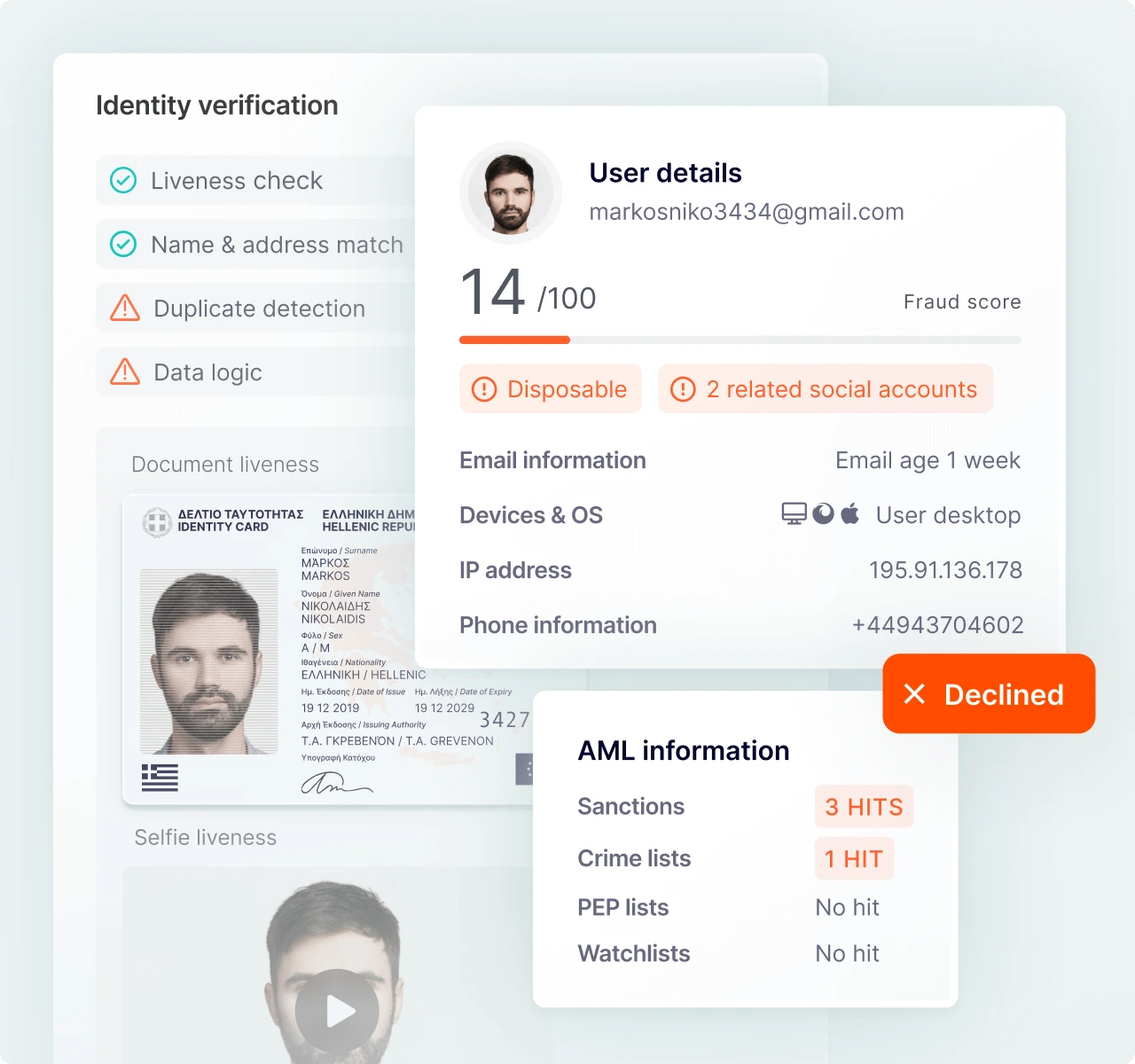

SEON’s solution is built on more than 900 real-time fraud signals, helping organizations assess not just whether an ID is real, but whether the person can be confidently approved based on identity and risk signals.

Most identity verification tools focus on validating documents, but lack the risk context needed to determine whether a user meets an organization’s risk-based requirements. As a result, both high-quality fakes and legitimate documents used by fraudsters can still pass these basic checks. SEON’s Identity Verification solution addresses this gap by combining core KYC checks with live fraud intelligence. This allows teams to filter out low-risk users through onboarding, while filtering out high-risk users before they consume KYC resources.

The solution supports identity document verification for global government-issued IDs, biometric liveness checks, proof of address verification and optional government database checks. Organizations can build verification workflows tailored to customer segment, risk profile or regulatory requirement, combining fraud signals, identity checks and AML screening based on their specific needs. All identity and fraud signals are surfaced in a single dashboard, reducing friction and eliminating silos among fraud, compliance and risk teams.

“Organizations have told us they’re managing separate tools for fraud detection, identity verification and AML compliance – each with its own data, workflows and operational overhead,” said Tamas Kadar, CEO, SEON. “We built Identity Verification to bring those decisions together. When you combine AI-powered document checks with real-time fraud intelligence, you stop attacks earlier, reduce wasted KYC spend and make faster, more confident approval decisions with a clear audit trail.”

The initial Identity Verification rollout focuses on Europe’s demanding regulatory environment. SEON worked closely with gaming and betting operators to meet strict compliance requirements while maintaining operational efficiency and improving both conversion and fraud outcomes. The solution strengthens SEON’s position across regulated industries including iGaming, fintech and digital platforms.

“The industry is moving toward bringing identity verification, fraud and AML into one decision layer, and SEON is helping to lead that shift,” said Filip Gvardijan, Head of Fraud Prevention at Superbet. “That shift matters. It cuts out pointless and expensive KYC cycles on users who were never legitimate, and also clears a faster path for legitimate users, removing a huge amount of avoidable and often manual work.”