Darwinium launches AI tools to detect and disrupt adversarial threats

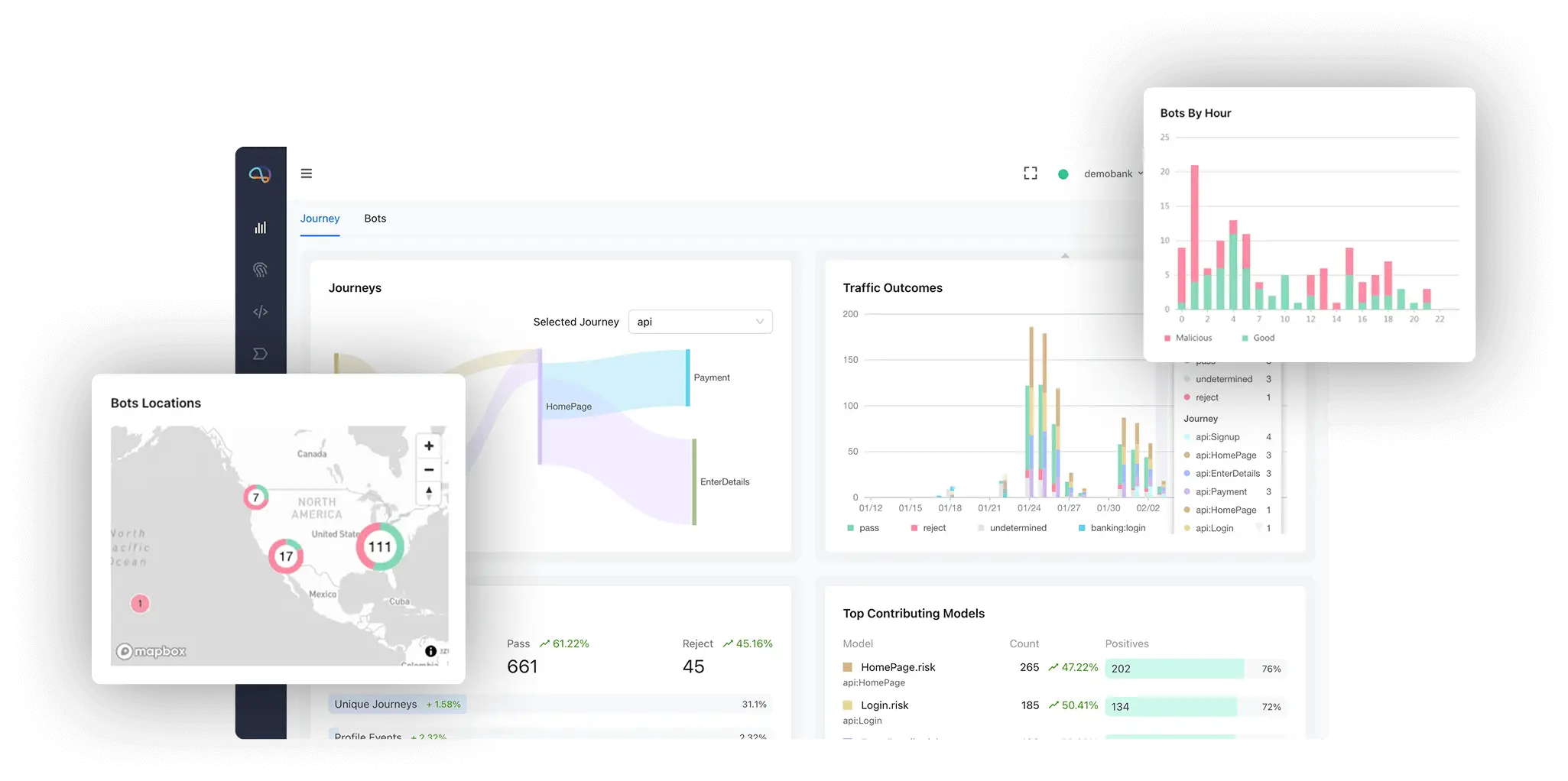

Just ahead of Black Hat USA 2025, Darwinium has announced the launch of Beagle and Copilot, two new agentic AI features that simulate adversarial attacks, surface hidden vulnerabilities, and dynamically optimize fraud defenses. As fraudsters increasingly deploy AI agents to evade detection and manipulate digital systems, Darwinium gives defenders their own autonomous AI capabilities, built natively into its behavioral intelligence platform.

“Consumers are using AI agents to shop faster. Fraudsters are using them to bypass defenses at scale,” said Alisdair Faulkner, CEO and Co-Founder of Darwinium. “The challenge isn’t detecting bots anymore, it’s distinguishing AI agents acting on behalf of good users versus malicious automation. Solving that problem requires a platform that speaks the same language: agentic AI.”

Darwinium Beagle: Agentic AI red-teaming to expose blind spots in fraud defenses

Beagle simulates complex adversarial behaviors using autonomous AI agents, enabling teams to proactively test detection and mitigation strategies in production-like environments. Unlike traditional rule testing or sandboxing, Beagle:

Emulates synthetic identities by generating realistic user profiles, including spoofed devices, geolocation variance, and behaviorally valid interaction patterns.

Navigates full user journeys, such as account creation, login, checkout, and support interactions, simulating attacks like:

- Synthetic identity creation using disposable emails and virtual numbers

- Credential stuffing with adaptive rate manipulation

- Behavioral mimicry to bypass biometric models

Identifies weak links in multi-layered defenses, including device fingerprinting, behavioral biometrics, velocity checks, and bot scoring systems.

Beagle integrates directly into Darwinium’s event-driven architecture to provide real-time telemetry and analytics on system response, detection efficacy, and unanticipated failure modes. It then feeds these insights back into the platform’s decision layer to autonomously harden risk policies, adapt detection logic, and optimize mitigation strategies, all without manual coordination between fraud, product, and engineering teams.

Darwinium Copilot: AI-optimized companion to streamline risk engineering

Darwinium Copilot serves as an intelligent assistant for fraud strategy, decision optimization, and platform interaction. Its core mission is to streamline user queries around complex fraud detection points of interest, such as “I’d like to find users who exhibit bot-like activity or are creating synthetic accounts.”

Built into the platform as an omnipresent chat window, Darwinium Copilot provides automatic suggestions for features, rules, and detection strategies that can improve fraud defense efficacy, leveraging its awareness of customer-specific data that may be indicative of malicious activity. It bridges human expertise and platform automation through:

- Automated feature and rule recommendations based on detected behavioral anomalies or patterns.

- Dynamic detection tuning that aligns with both fraud mitigation and user experience goals.

- Streamlined access to Darwinium’s documentation and proactive automation of common platform tasks on behalf of users.

Additional key functionalities include:

- Impact analysis: Evaluate risk configuration changes safely before deployment.

- Trade-off quantification: Measure user friction versus fraud losses within controlled testing environments.

- Operational efficiency: Rapidly identify optimization opportunities to refine decision logic and improve trust outcomes.

By automating the feedback loop between detection, decisioning, and business impact, Darwinium Copilot reduces the manual effort required for fraud prevention, particularly valuable in high-scale environments.

“As AI evolves, fraud teams must understand the intent behind AI agent behavior,” says David Barnhardt, Strategic Advisor, Fraud and AML at Datos Insights. “It’s no longer enough to spot anomalies, we need to separate good agents from malicious ones in real time to stay ahead of fraud.”