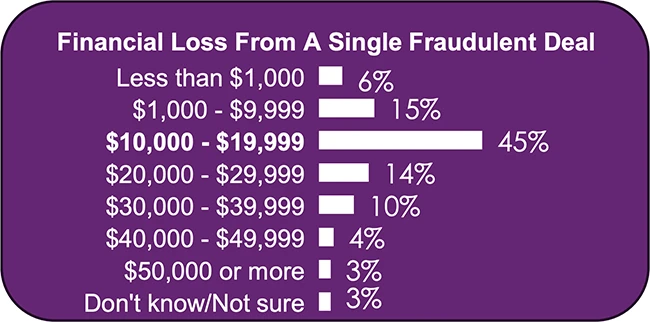

Auto finance fraud is costing dealers up to $20,000 per incident

Auto retailers see fraud as a regular part of selling and financing vehicles, something that shows up often enough to plan around, according to Experian.

Income and identity fraud lead the list

Most fraud problems start with the borrower. Income and employment misrepresentation rank as the most common issues. Fake pay stubs, altered bank statements, and inflated job details continue to surface during loan applications.

Identity fraud follows closely behind. Respondents pointed to synthetic identity fraud, third party identity fraud, and straw borrower schemes as recurring threats. In many cases, applications appear legitimate during early review. Names, addresses, and credit files line up well enough to move forward. Problems surface later, when payments stop or the borrower cannot be reached.

Vehicle related fraud still plays a role, though it appears less often than borrower driven schemes. Trade in vehicle deception, forged VINs, and ownership conflicts tend to surface after deals close, adding work when recovery options are already limited.

“The best defense is simple: confirm identities upfront using multiple data sources, verify income and employment early, validate trade-in vehicle details so clean deals move quickly, and flag anything that doesn’t add up. Dealers who take the time to leverage advanced fraud-detection tools to assess shoppers’ incomes and identities are best positioned to avoid major losses and reduce friction during the car buying process,” said Jim Maguire, Experian’s senior director for automotive.

Fraud is often spotted after the deal

Fraud is rarely obvious at the point of sale. Many warning signs show up only after funding. Skip borrowers and unrecoverable vehicles stand out as key indicators. Early payment defaults also raise concern, especially when missed payments happen soon after delivery.

Many dealers said they spot fraud within days, while others admitted it can take weeks. When it is caught later, the losses usually add up. Several respondents pointed out that by the time fraud is confirmed, the car is already gone, or the borrower has vanished.

Stores reported stopping more fraudulent deals than they complete. Still, a small number make it through each year, and even a few cases can carry meaningful cost.

The financial hit lands in familiar places

When fraud turns into a loss, it usually shows up in predictable places. Lender chargebacks were cited frequently, along with trade ins that come with lien or ownership issues. Failed financing approvals also leave stores exposed after a vehicle has already left the lot.

Insurance and lenders absorb part of the damage, though coverage varies. Retailer often carry a meaningful share of the loss through unrecovered balances and the internal time spent sorting out what went wrong.

Respondents estimated that fraud contributes to a noticeable portion of loan defaults across the industry. While individual cases may seem manageable, the cumulative impact adds up over time.

Prevention relies on judgment and process

Responsibility for fraud mitigation usually sits with finance and risk leaders. Heads of finance and insurance, along with fraud or risk managers, carry most of the oversight. Sales staff often help spot issues, though formal accountability remains centralized.

Verification practices still rely heavily on manual review. License scanners, photocopies, and visual ID checks remain common, alongside electronic validation tools. Human review plays a large role in deciding whether something feels off.

Income checks can look different from one store to the next. Some teams verify income on every deal, while others only dig in when something doesn’t quite add up or when a lender asks for it. In most cases, customer-provided documents are still the main source, with third-party verification tools used as a backup or extra layer of assurance.