Digital transformation drives middle market resiliency

Digital transformation has tipped from buzzword to baseline in the middle market, and not a moment too soon. As the COVID-19 pandemic threatens the health of people and businesses across every sector, middle market companies that have built resiliency into their business through digital transformation have more tools to endure disruption.

The good news: BDO’s survey, which polled 600 C-level executives, finds that 100% of respondents are currently implementing a digital transformation strategy or are in the process of developing one.

However, with virtually all businesses planning for digital transformation and a challenging economic climate ahead, the stakes are higher than ever.

“A crisis like the pandemic can lead some organizations to pause or de-emphasize innovation,” said Malcolm Cohron, National Digital Transformation Services Leader, BDO Digital.

“But now more than ever, it’s critical to continue developing digital capabilities that enable success for both the present and future. Deploying digital initiatives strategically can help protect revenues and identify unmet customer needs.”

Digital priorities

While the pandemic has likely shifted short-term business objectives to focus on operational efficiency and effectiveness, in the long term, middle market executives say that the top objectives for their digital strategy are diversifying revenues and modernizing IT infrastructure.

Middle market companies point to four key value drivers of digital transformation.

Enhanced operational efficiency: A majority of C-level executives (58%) say increasing operational efficiencies is a top short-term business goal. Adapting to change and volatility in this environment requires greater agility and urgency, and the ability to do more with less.

Breaking down artificial barriers within an organization can help integrate processes with the flow of information, which enables better collaboration and decision-making.

Stronger digital resilience: As millions shift to remote work, pivot production to new sites and double down on digital revenue streams, cyber threats are escalating. With the stakes for digital resilience high, a plurality of executives (39%) cite cyberattacks as their top digital threat and 59% say bolstering cybersecurity is one of their top short-term business goals.

Improved customer experience: Businesses will fight to preserve revenue during this period of economic disruption, and customer retention can be the difference between sustaining through the crisis and not.

As customer behaviors shift, digital transformation can help provide customers with better service and, perhaps more importantly, identify unmet needs. This will be essential to staying relevant in a dynamic market. 68% say improving customer experience is their top short-term business goal, and 22% cite it as their #1 digital priority.

Revenue opportunity: Cash flow is now a critical challenge for many middle market companies, but digital transformation can help them protect and increase revenue.

As companies adapt their approach to priority goods and services and identify opportunities for growth in the new market, data-driven planning and innovation is critical. In the long-term, diversifying revenue is companies’ most-cited business objective.

Digital transformation roadblocks

With digital transformation in the works across the middle market, the devil will be in the details. C-level executives are up against several challenges.

Crisis: For many organizations, the pandemic’s impact on their employees, suppliers and customers makes it an existential business threat. But bracing and hoping for a “return to normal” rather than responding and adapting for resilience risks obsolescence.

This crisis should serve as the catalyst for accelerating digital transformation and adoption across an organization, as well as increasing the willingness to experiment, learn and scale within a compressed timeframe.

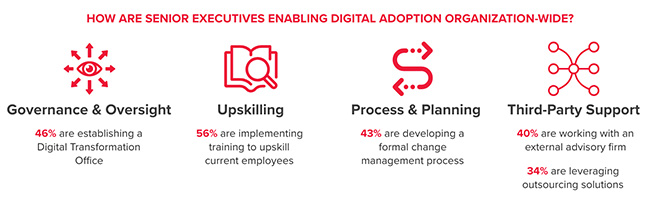

Change management: The data is clear—a robust change management plan can make or break a digital initiative. Middle market companies point to lack of skills or training (41%), employee pushback (30%), poor communication or project management (28%) and lack of leadership or vision (28%) as top reasons for digital efforts failing.

Change readiness is a function of culture, commitment and capacity to meet the objective and see it through. In a time of competing priorities, systemizing an approach to change management is more essential to organizational agility than ever.

Cash flow: C-level executives point to budget and resource constraints as a top challenge to moving forward with a new digital initiative. However, even as priorities shift to adapt to the new market, the case for digital spending is growing, not shrinking.

Leaders of digital transformation will need to make the business case for how spending on digital initiatives can help preserve revenue and capital to make the entire business more resilient.

Financial services

Having a robust digital strategy is no longer a differentiator for banking, insurance and asset management industries. According to the survey, execution is essential.

In a new market, finance executives are shifting their digital strategy towards initiatives that provide a seamless customer interaction, address unmet needs and shore up cybersecurity protections to safeguard data.

Healthcare

Telehealth and digital-enabled care have reached a tipping point in healthcare’s response to the pandemic. As consumer care needs evolve, the survey shows that the era of value-based care has arrived in full force and healthcare organizations are focused on agility, ensuring better upstream and downstream care coordination and reimagining the drug and medical supply chain to improve care.

Manufacturing

As COVID-19 makes the business case for Industry 4.0 an imperative, manufacturers that have led in innovation are better poised to weather today’s storms. This is not lost on manufacturers: One-third are currently implementing their Industry 4.0 strategy, up from just 5% in 2019, according to the survey.

Retail

Retailers have long been champions for digital innovation and transformation. Today, it’s a requirement for both success and agility amid brand new customer behavior and changing needs.

Retailers are transforming with intention to keep pace with the “Amazonification” of the retail ecosystem. They are especially focused on improving the customer experience to attract and retain interest from the uptick in homebound consumers shopping online.

Technology

Middle market technology companies are helping to enable resilience across multiple sectors, but must also build up internal efficiency and security to meet the moment. For technology companies, there is a balance between risk and innovation as they refocus on infrastructure, ethics, and reliability to navigate new regulation and enhance trust with consumers.

Energy

Mid-market power generation companies must navigate COVID-19’s impacts and ensuing economic fallout by lowering production costs and boosting operational efficiencies, while simultaneously improving the speed and reliability of service as they move toward cleaner energy sources.

The survey finds they are focusing their technology spending on driving operational efficiencies and adopting new business or revenue models.