Regula simplifies identity verification with its new all-in-one IDV Platform

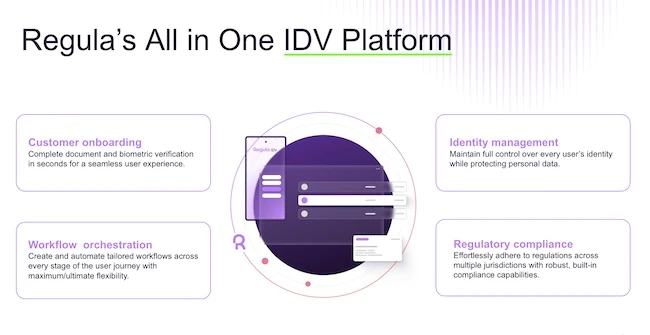

Regula has launched its Regula IDV Platform. This ready-to-use orchestration solution is designed to replace fragmented identity verification and management systems with a single, unified workflow. Built to scale according to an organization’s growth pace and fully vendor-agnostic, the platform enables businesses to manage every stage of the identity lifecycle, from onboarding through continuous reverification, without legacy constraints.

Today, nearly half of companies worldwide face the same identity verification challenges. Legacy systems lead to fragmentation and create blind spots in the processes. Enterprise environments often rely on a mix of services: one vendor for document checks, another for biometrics, a separate one for sanctions lists, etc., with data manually stitched together in inconsistent, sometimes chaotic ways.

Every new application or service only adds another layer of complexity to the IDV infrastructure. This results in growing costs, increased security risks, and higher customer drop-off rates.

Solving IDV pain points with Regulas

One-stop-shop solution. Regula IDV Platform unites the most comprehensive set of identity checks, from documents to biometrics, eliminating repeated uploads and failed or unnecessary steps. As a result, it transforms onboarding into a single, seamless, and trusted flow with proprietary solutions for the entire identity journey. Users complete verification in seconds, not minutes, while organizations get a unified, enterprise-grade solution.

Flexible workflow orchestration. Regula IDV Platform makes complex, multi-step, multi-component identity verification workflows effortless. Unlike point solutions that handle single tasks, the platform supports complete end-to-end use cases. Easy customization capabilities allow companies to build adaptable verification processes aligned with their business needs.

Unified tools. The platform unites everything in one place: document and biometric checks, AML (Anti-Money Laundering) and PEP (Politically Exposed Persons) screening, databases, and more. Its vendor-agnostic architecture integrates with any tech stack and third-party systems, saving time and resources and closing blind spots.

Comprehensive identity management. Regula IDV Platform maintains a single source of truth with centralized user profiles, secure storage, and advanced analytics. It optimizes decision-making with transparent, reliable identity data and reduces complexity with single-flow user authentication.

Built-in compliance. From KYC (Know Your Customer) and AML to GDPR (General Data Protection) and CCPA (California Consumer Privacy Act) and more, all required checks are included by default. Regula IDV platform keeps complete audit trails, protects sensitive data and provides full control over it, and allows both on-premise and cloud deployment. Additionally, the platform supports age assurance to instantly confirm age, protect minors, and comply with local regulations.

Lower costs, faster scaling. By consolidating multiple solutions into a single platform, Regula helps to reduce operational expenses. This agile platform grows together with businesses—easily adapting to changing processes, expanding integrations, regulatory updates, or increased workloads—without costly redevelopment or re-integration.

Beyond the orchestration of identity verification and management tools, the Regula IDV Platform ensures speed and flexibility. Its workflows and integrations let companies get started instantly without long setups. User data management and analytics tools help businesses store, process, and analyze identity data to optimize operations and decision-making. Thanks to its multilingual, multi-document, and multi-device support, the platform delivers native user experiences across geographies and channels and ensures reliable verification anywhere in the world.

Regula IDV Platform also supports the creation and reuse of digital credentials, verified identity attributes issued by trusted organizations such as banks, telecom providers, or government services. Once a user’s identity is confirmed during the KYC process, these credentials can be securely reused to authorize access to other services, with biometric verification ensuring authenticity at every step. This approach empowers businesses to streamline user journeys, enhance security, and take part in the growing digital identity ecosystem.

“For years, businesses have struggled with fragmented identity systems that are costly, slow, and hard to adapt. With Regula IDV Platform, we’ve taken our decades of in-house expertise in document and biometric verification and turned it into a single, unified solution. This platform gives enterprises the agility they need to scale, the flexibility to integrate with any system, and the orchestration capabilities to connect multiple processes into one seamless flow with the reliability of the most comprehensive identity checks—all while reducing complexity and cost. It’s the next step in helping organizations make identity verification both a strategic advantage and a seamless experience for their customers,” says Ihar Kliashchou, Chief Technology Officer at Regula.